property tax assistance program illinois

We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. It is managed by the local governments including cities counties and taxing districts.

2021 Property Tax Bill Assistance Cook County Assessor S Office

The Property Tax Assistance Program provides assistance to individuals or families who are delinquent on property tax payments.

. CAAs may partner with local. Beginning January 1 2001 legislation will take effect that. The amount of tax relief is relatively minor.

Homeowners will still be able to deduct 5 of their property tax bills up to 300 from their income taxes but the new plan would double the value of that deduction with a. Senior Citizens Property Tax AssistanceSenior Freeze. Recognizing the financial toll of the coronavirus and the pressing.

This help comes in the form of income and property tax rebates and a temporary. The property must be occupied for 10 continuous years or 5 continuous years if the person receives assistance to acquire the property as part of a government or non-profit housing program. The Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens.

You can use the Illinois Property Tax Credit on your income tax return. Cook County announces property tax relief for County property owners. The homeowner or homestead exemption allows you to take 10000 off of your EAV.

On July 1 the Illinois Family Relief Plan takes effect in the tune of an estimated 18 billion. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call. The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a.

Pritzker Administration Announces 309 Million Assistance Program for Illinois Homeowners Impacted by COVID-19. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available.

This exemption limits EAV increases to a specific annual percentage increase that is. If you are a. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families.

Wed 05132020 - 1200. ROCK ISLAND Illinois KWQC - Illinois homeowners experiencing financial hardship associated due to the COVID-19 pandemic can apply for a housing assistance grant. The Illinois Property Tax Credit Can Help You Reduce Your Taxes.

A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. The 10000 reduction is the same for every home no matter its market value or EAV. There may be some assistance available for delinquent property taxes in Winnebago County Illinois.

The Illinois Department of Revenue does not administer property tax. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemic. The City of Chicago Property Tax Rebate Program provides working- and middle-class families and seniors some property tax relief through a City-funded rebate.

Homeowners can apply for up to 30000 in assistance at. I hope this information helps you. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available.

31 rows Purpose of the Property Tax Relief Program. This credit equals five percent of the Illinois. Property Tax Assistance Will County Illinois.

Illinois Property Tax Exemptions What S Available Credit Karma

Pritzker To Offer Relief On Groceries Gas Property Taxes Illinois News Us News

Property Tax Village Of Carol Stream Il

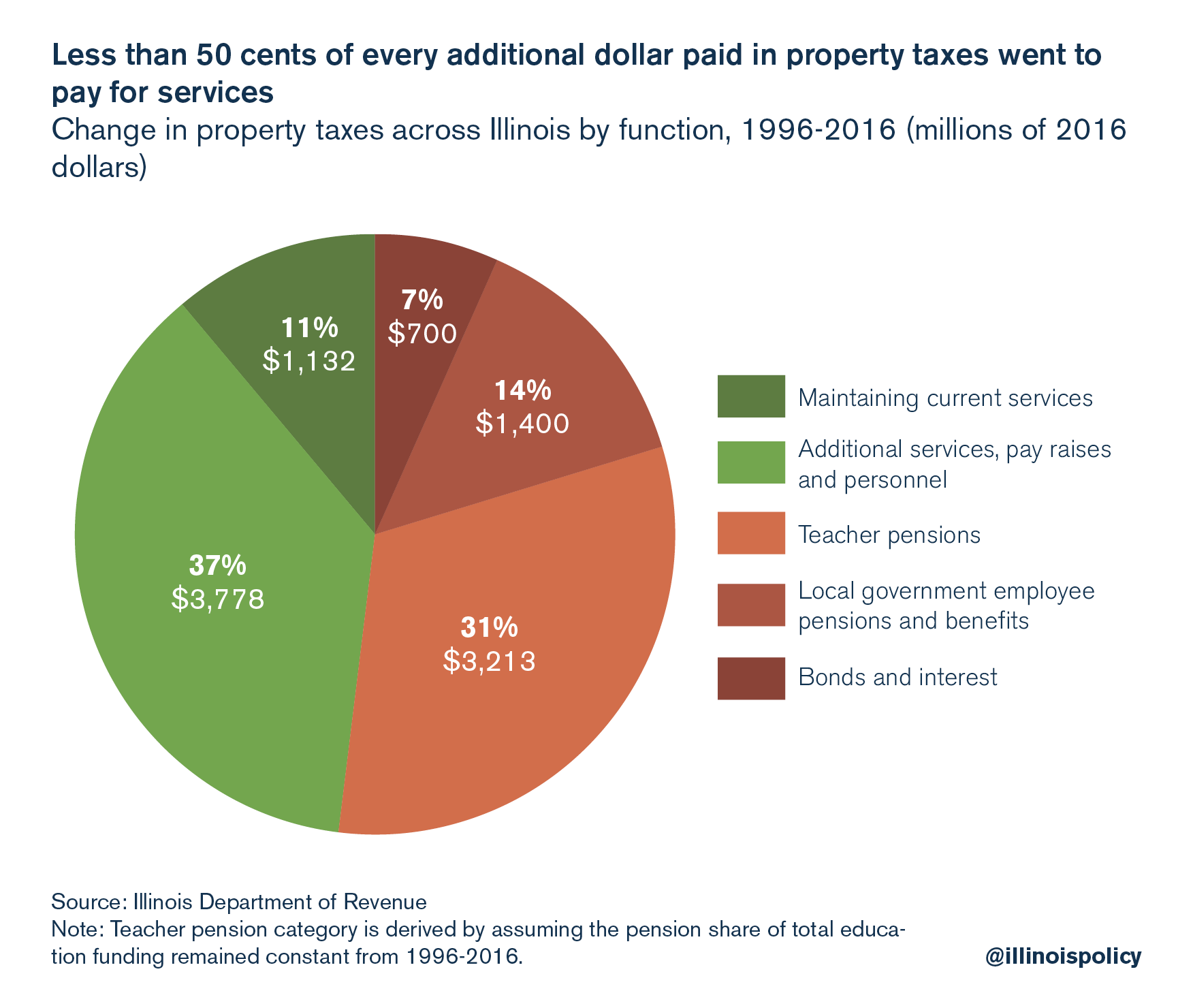

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Where Do Your Property Tax Dollars Go The Civic Federation

Property Tax City Of Decatur Il

Sen Wilcox To Serve On Property Tax Relief Task Force Craig Wilcox

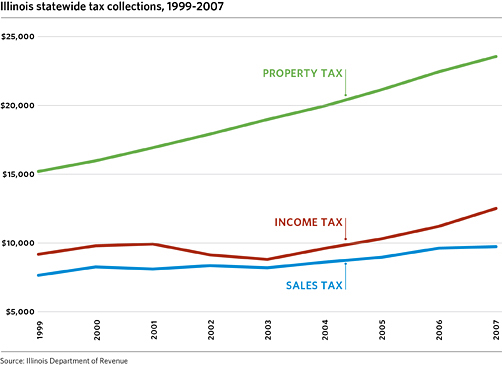

Dusting Off The Income Property Tax Swap Debate Cmap

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Property Taxes By State Embrace Higher Property Taxes

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

Dusting Off The Income Property Tax Swap Debate Cmap

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Taxes By State In 2022 A Complete Rundown

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

New Illinois Law Provides Property Tax Relief To Some Residents Here S What It Includes Nbc Chicago

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)